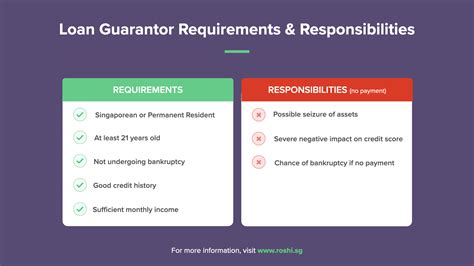

In Singapore, a loan guarantor is an individual who promises to repay a loan if the primary borrower defaults. This agreement is legally binding, making it a significant financial commitment. Understanding the requirements for becoming a loan guarantor is crucial to ensure you fully comprehend the responsibilities involved.

What are the Requirements to be a Loan Guarantor in Singapore?

1. Minimum Age

To be a loan guarantor in Singapore, you must be at least 21 years old.

2. Good Credit Score

Lenders typically require guarantors to have a good credit score, usually between 650 and 700.

3. Sufficient Income

Guarantors should have a stable income that is sufficient to cover their own expenses and the potential loan payments if the primary borrower defaults.

4. Assets

Lenders may also consider the assets of the guarantor, such as savings, investments, or property. This helps ensure the guarantor has the financial ability to repay the loan if necessary.

5. Relationship to the Borrower

In most cases, guarantors are closely related to the borrower, such as parents, siblings, or spouses. This is because lenders prefer individuals with a vested interest in the borrower’s financial well-being.

What are the Risks of Being a Loan Guarantor?

1. Legal Liability

As a guarantor, you are legally responsible for repaying the loan if the primary borrower defaults. This means you could potentially be sued and have your assets seized if the loan is not repaid.

2. Financial Strain

If the primary borrower defaults on the loan, you could be faced with significant financial strain. You may have to make monthly payments, which can put a strain on your own finances.

3. Damage to Credit Score

If the primary borrower defaults on the loan, it will negatively impact your credit score. This can make it more difficult for you to obtain credit in the future.

How to Evaluate if Being a Loan Guarantor is Right for You

1. Consider Your Financial Situation

Before agreeing to be a guarantor, carefully assess your financial situation. Ensure you have sufficient income and assets to cover potential loan payments if the primary borrower defaults.

2. Understand the Legal Implications

Make sure you fully understand the legal implications of being a loan guarantor. Seek professional advice if necessary to ensure you are aware of your responsibilities.

3. Discuss with the Borrower

Openly discuss the loan with the primary borrower. Understand their financial situation and repayment plans to assess their likelihood of repaying the loan.

4. Consider Your Relationship

Evaluate your relationship with the borrower. Are they responsible and likely to repay the loan on time? Is the loan amount reasonable given your relationship?

Conclusion

Being a loan guarantor in Singapore carries significant financial and legal responsibilities. By understanding the requirements and risks involved, individuals can make an informed decision about whether guarantying a loan is right for them. Careful consideration and thorough due diligence are essential to safeguard financial well-being and maintain positive relationships.