No, P2P lending is not illegal.

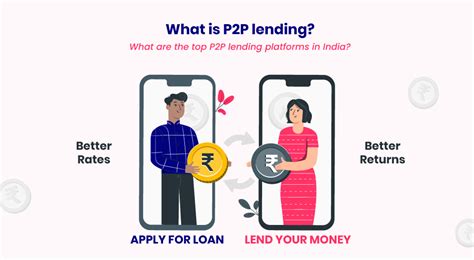

What is P2P Lending?

P2P lending, also known as peer-to-peer lending, is a type of lending that connects borrowers and lenders directly, without the involvement of a traditional financial institution. It is a rapidly growing industry, with the global P2P lending market expected to reach $460 billion by 2025.

How Does P2P Lending Work?

P2P lending platforms provide a marketplace where borrowers can list their loan requests and lenders can browse and invest in the loans that they find most attractive. The platforms typically charge a fee to borrowers for listing their loans and a fee to lenders for investing in loans.

Is P2P Lending Safe?

The safety of P2P lending depends on a number of factors, including the platform you use, the borrower’s creditworthiness, and the terms of the loan. However, there are a number of risks associated with P2P lending, including the risk of default, the risk of fraud, and the risk of interest rate fluctuations.

How to Avoid the Risks of P2P Lending

There are a number of steps you can take to avoid the risks of P2P lending, including:

- Choosing a reputable platform. There are a number of P2P lending platforms available, so it is important to do your research and choose a platform that is reputable and has a good track record.

- Investing in loans that are appropriate for your risk tolerance. P2P loans are available with a range of risk levels, so it is important to invest in loans that are appropriate for your risk tolerance.

- Diversifying your portfolio. It is important to diversify your P2P lending portfolio by investing in a number of different loans. This will help to reduce your risk of loss if one or more of your borrowers defaults.

Benefits of P2P Lending

There are a number of benefits to P2P lending, including:

- Higher returns. P2P loans typically offer higher returns than traditional savings accounts or certificates of deposit.

- Flexibility. P2P loans can be used for a variety of purposes, including debt consolidation, home improvement, and business expansion.

- Social impact. P2P lending can help to support small businesses and entrepreneurs who may not be able to get financing from traditional banks.

Conclusion

P2P lending is a legitimate and regulated industry that can offer a number of benefits to both borrowers and lenders. However, it is important to be aware of the risks involved and to take steps to mitigate those risks before investing in P2P loans.