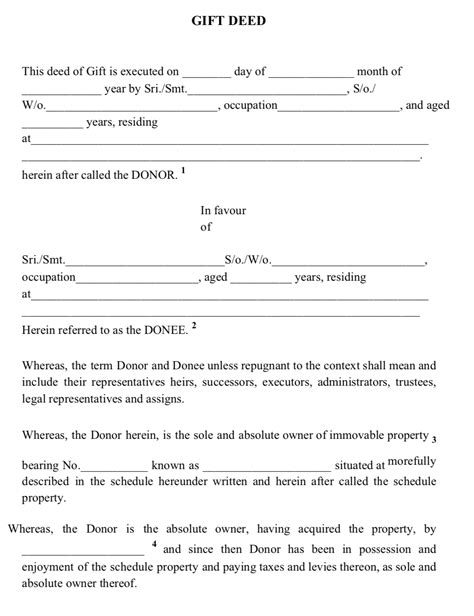

Yes, a gift deed is a legal document that transfers the ownership of a property from one person to another without any payment involved. It is considered a deed because it meets the legal requirements for a valid conveyance of property.

What is a Gift Deed?

A gift deed is a written document that is used to transfer the ownership of a property, such as land, a house, or other real estate, from one person (the donor) to another person (the donee) for free. The donor must have the legal capacity to make the gift and the donee must accept the gift.

Key Features of a Gift Deed

- No Payment Involved: The defining characteristic of a gift deed is that there is no payment or consideration involved in the transfer of ownership. The property is given as a gift from the donor to the donee.

- Legal Transfer: Despite the lack of payment, a gift deed is a legally binding document that transfers the ownership of the property from the donor to the donee. The donee becomes the legal owner of the property upon the execution of the deed.

- Irrevocable: Once a gift deed is executed and delivered, it is generally irrevocable. The donor cannot change their mind and take back the property unless there is fraud, duress, or other legal grounds for voiding the deed.

Why Use a Gift Deed?

There are several reasons why people may use a gift deed:

- Transferring Property to Family Members: Gift deeds are commonly used to transfer property to family members, such as children or grandchildren, without incurring any gift tax or other financial burdens.

- Estate Planning: Gift deeds can be used as part of an estate plan to reduce the value of an estate for tax purposes or to ensure that certain assets are distributed according to the donor’s wishes.

- Avoiding Probate: Transferring property through a gift deed can help avoid the probate process, which can be time-consuming and expensive.

Considerations When Using a Gift Deed

It is important to note that gift deeds are subject to certain legal requirements and considerations:

- Legal Capacity: The donor must have the legal capacity to make a gift, which means they must be of sound mind and body and not under any undue influence or coercion.

- Acceptance by Donee: The donee must accept the gift and sign the deed to indicate their agreement to the transfer of ownership.

- Tax Implications: Gift deeds may have tax implications, such as gift tax or capital gains tax, depending on the value of the property and the relationship between the donor and donee.

- Recording: Gift deeds must be properly recorded with the appropriate government office to ensure that the transfer of ownership is legally effective.

Conclusion

A gift deed is a legally binding document that transfers the ownership of a property from one person to another without any payment involved. It is a valid form of conveyance and can be used for a variety of purposes. However, it is important to understand the legal requirements and considerations associated with using a gift deed to ensure that the transfer of ownership is valid and meets the intended goals.