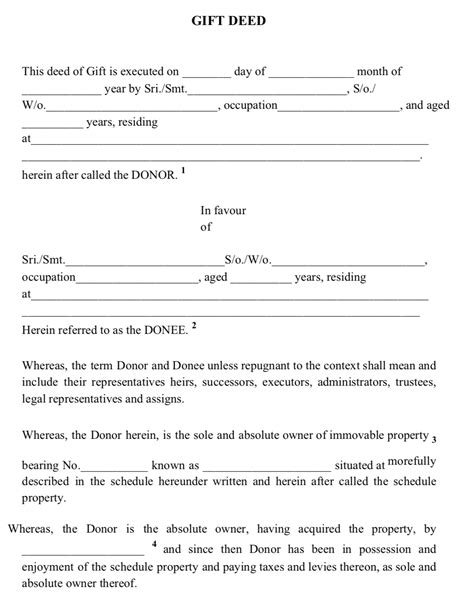

A gift deed is a legal document by which a donor transfers property to a donee without any consideration in return. It is a voluntary transfer of property, and the donor does not receive any payment or other benefit for the transfer.

What are the key features of a gift deed?

- It is a voluntary transfer. The donor must freely and willingly transfer the property to the donee. There should be no pressure or coercion involved.

- It is a transfer of property. The gift deed must transfer ownership of the property to the donee. The donor must have the legal capacity to transfer the property, and the property must be capable of being transferred.

- It is without consideration. The donor does not receive any payment or other benefit in return for the transfer of property. The transfer must be absolute and unconditional.

Is a gift deed really a deed?

Yes, a gift deed is a deed. It is a legal document that transfers property from one person to another. It is different from a sale deed in that the donor does not receive any payment or other benefit in return for the transfer of property.

What are the benefits of a gift deed?

There are several benefits to using a gift deed to transfer property.

- It is a simple and inexpensive way to transfer property. The process of creating and executing a gift deed is relatively simple and inexpensive. There is no need to pay for legal fees or other professional services.

- It can be used to transfer property to a minor. A gift deed can be used to transfer property to a minor child. The child will become the legal owner of the property, but the parent or guardian will have the right to manage the property until the child reaches the age of majority.

- It can be used to transfer property to a trust. A gift deed can be used to transfer property to a trust. The trust will become the legal owner of the property, and the trustee will have the right to manage the property according to the terms of the trust.

What are the risks of a gift deed?

There are also some risks associated with using a gift deed to transfer property.

- The donor may not be able to get the property back. Once a gift deed is executed, the donor cannot get the property back unless the donee agrees to return it.

- The gift may be subject to gift tax. If the value of the gift exceeds the annual gift tax exclusion, the donor may be subject to gift tax.

- The gift may be challenged by creditors. If the donor has creditors, they may be able to challenge the gift if it was made with the intent to defraud creditors.

Conclusion

A gift deed is a legal document that can be used to transfer property from one person to another without any consideration in return. It is a simple and inexpensive way to transfer property, but there are also some risks associated with using a gift deed.