As a prospective borrower in Singapore seeking a loan, understanding the role and requirements of a loan guarantor is crucial. A loan guarantor is an individual who promises to repay your loan amount in case you default. Their backing provides additional security to lenders, potentially increasing your chances of loan approval and accessing favourable loan terms.

Who Can Be a Loan Guarantor in Singapore?

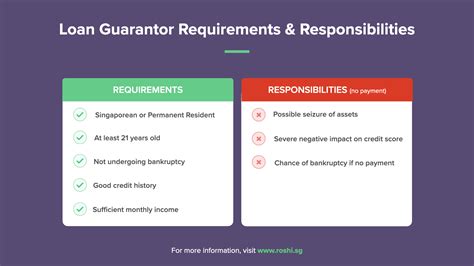

To qualify as a loan guarantor in Singapore, an individual must typically meet the following criteria:

- Age: Be at least 21 years old

- Citizenship: Be a Singapore Citizen or Permanent Resident

- Income: Have a stable and sufficient income to cover their own financial obligations and the potential liability as a guarantor

- Credit History: Possess a good credit history with no history of bankruptcy or defaults

- Relationship: Be closely related to the borrower, typically a spouse, parent, or sibling

Responsibilities of a Loan Guarantor

As a guarantor, you assume significant responsibilities, including:

- Legally bound to repay the loan if the borrower defaults

- Potential impact on your credit score if you have to fulfil the guarantee

- May be required to provide financial information and undergo a credit check

Benefits of Having a Loan Guarantor

Despite the responsibilities, having a loan guarantor offers several advantages:

- Increased Loan Approval Chances: A guarantor’s backing can enhance your loan application’s credibility, leading to a higher likelihood of approval.

- Lower Interest Rates: Lenders may offer lower interest rates to borrowers with a guarantor, recognising the reduced risk involved.

- Larger Loan Amounts: With a guarantor’s support, you may qualify for larger loan amounts as lenders are more confident in your ability to repay.

How to Find a Loan Guarantor

Finding a suitable loan guarantor can be challenging. Consider the following strategies:

- Family and Friends: Approach close family members or friends who meet the eligibility criteria and are willing to support you.

- Professional Guarantor Services: Certain companies or individuals provide professional guarantor services for a fee.

Conclusion

Understanding the requirements and responsibilities of a loan guarantor is vital when seeking loans in Singapore. By carefully evaluating your options and ensuring your guarantor meets the necessary criteria, you can maximise your chances of securing favourable loan terms and achieving your financial goals.