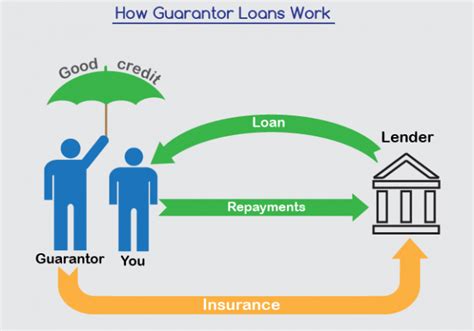

When applying for a loan, you may be asked to provide a guarantor. A guarantor is someone who agrees to repay your loan if you are unable to do so. To be a guarantor, you must meet certain criteria.

What Qualities do Lenders Look for in a Guarantor?

- Good credit history: Lenders want to be sure that the guarantor has a good credit history and is able to manage their own finances responsibly.

- Sufficient income: The guarantor must have sufficient income to cover their own financial obligations as well as the loan repayments if you are unable to make them.

- Stable employment: Lenders prefer guarantors who have a stable employment history and are not at risk of losing their job.

- Close relationship to the borrower: Lenders often prefer guarantors who have a close relationship to the borrower, such as a family member or close friend. This is because they are more likely to be willing to help the borrower if they are unable to make the loan repayments.

- No history of bankruptcy: Lenders will not consider guarantors who have a history of bankruptcy. This is because it indicates that the guarantor has not been able to manage their finances responsibly in the past.

How to Find a Guarantor

If you need to find a guarantor for a loan, you can start by asking family members or close friends. You can also ask your bank or credit union if they offer a guarantor service.

What are the Risks of Being a Guarantor?

There are some risks associated with being a guarantor on a loan. If the borrower is unable to make the loan repayments, you will be responsible for doing so. This could have a negative impact on your credit history and your finances.

What are the Benefits of Being a Guarantor?

Being a guarantor on a loan can also have some benefits. For example, it can help the borrower to get a lower interest rate on their loan. It can also help the borrower to build their credit history.

Conclusion

If you are considering being a guarantor on a loan, it is important to understand the criteria that lenders will look for. You should also be aware of the risks and benefits of being a guarantor.