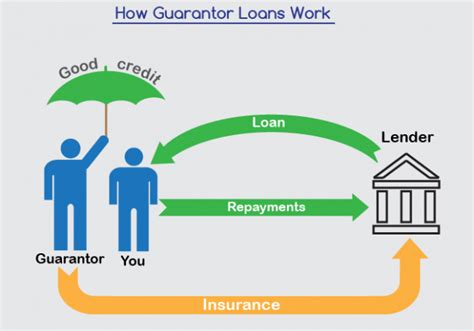

A guarantor is someone who agrees to repay a loan if the borrower fails to do so. Lenders often require guarantors for loans, especially if the borrower has a poor credit history or a low income.

What are the criteria for a guarantor?

To be a guarantor, you must:

- Be at least 18 years old

- Have a good credit history

- Have a sufficient income to cover the loan payments if the borrower defaults

What are the risks of being a guarantor?

If the borrower defaults on the loan, you will be legally obligated to repay the debt. This could damage your credit score and make it difficult for you to obtain credit in the future.

Should I consider being a guarantor?

Before you agree to be a guarantor, you should carefully consider the risks involved. You should only agree to be a guarantor if you are confident that the borrower will be able to repay the loan and if you are prepared to repay the debt yourself if necessary.

Table: Guarantor criteria

| Criteria | Description |

|---|---|

| Age | Must be at least 18 years old |

| Credit history | Must have a good credit history |

| Income | Must have a sufficient income to cover the loan payments if the borrower defaults |

Conclusion

Being a guarantor can be a risky proposition, but it can also be a way to help someone you care about. If you are considering being a guarantor, you should carefully consider the risks involved and make sure that you are comfortable with them.